News Nexus

Your source for the latest in general news and information.

Trade Bots in CS2: Your New Best Friend or Just Another Fad?

Discover if trade bots in CS2 are your ultimate ally or just a fleeting trend. Dive in for insights that could change your game!

Understanding How Trade Bots Work in CS2: A Comprehensive Guide

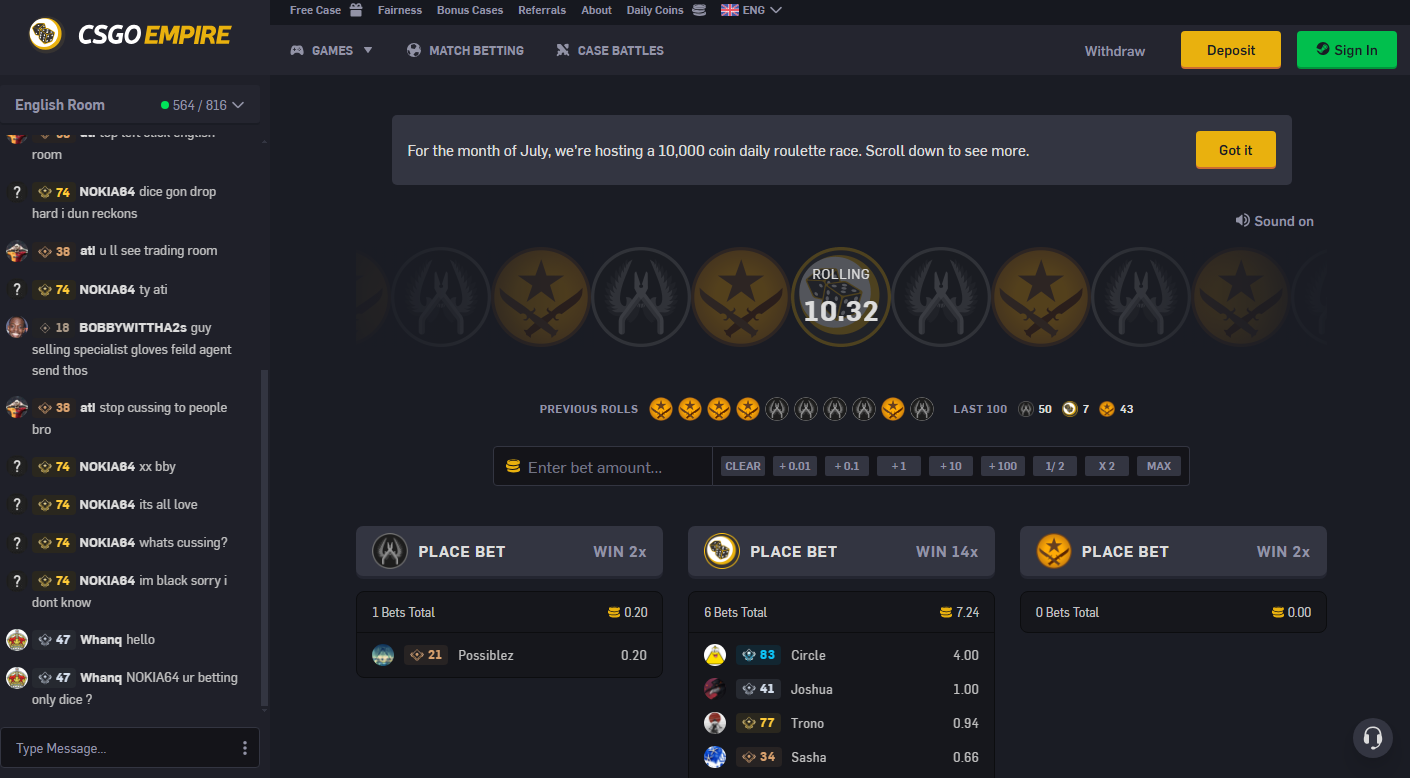

In recent years, the use of trade bots in CS2 has gained significant traction among players looking to optimize their trading strategies. These automated tools operate by executing trades on behalf of users, utilizing algorithms that analyze market trends and player demand in real-time. Understanding how these bots work requires a dive into the underlying technology, which often includes machine learning algorithms and various statistical models that enable the bot to make informed decisions quickly. As the in-game economy fluctuates, trade bots can maintain a competitive edge by continuously adjusting their strategies based on current market conditions.

To truly grasp the mechanics of trade bots in CS2, it’s essential to explore their key functionalities. Most bots employ features like

- Market Analysis: Scanning the marketplace for profitable opportunities.

- Order Management: Keeping track of ongoing trades and adjusting offers based on changes in supply and demand.

- Risk Assessment: Evaluating potential risks associated with trades and setting limits to minimize losses.

Counter-Strike is a popular team-based first-person shooter that has gained a massive following since its release. Players can improve their skills by learning various strategies and tactics, and they often seek information on how to check trade history on Steam. For more information, you can read about how to check trade history Steam.

Are Trade Bots in CS2 Worth the Hype? Pros and Cons Explored

The emergence of trade bots in Counter-Strike 2 (CS2) has sparked a substantial debate within the gaming community. Advocates argue that these automated programs can significantly enhance trading efficiency, allowing players to secure better deals and manage their inventories with ease. With features such as real-time market analysis and instant trading capabilities, trade bots offer a level of convenience that manual trading simply cannot match. However, critics warn that reliance on these bots may lead to a lack of personal touch in trades and the potential for market manipulation, posing risks that gamers should carefully consider.

When evaluating whether trade bots in CS2 are worth the hype, it's essential to weigh their pros and cons.

- Pros: Increased efficiency, better market insights, and consistent trading opportunities.

- Cons: Potential loss of personal interaction, risk of scams, and the possibility of banishment from trading platforms if misused.

Do Trade Bots Really Improve Your Trading Experience in CS2?

In the ever-evolving landscape of competitive gaming, many players are finding themselves asking, do trade bots really improve your trading experience in CS2? Trade bots have emerged as a popular tool for streamlining the transaction process between players. By automating trades and minimizing human error, these bots can enhance the overall efficiency of trading. Players can easily access various skins and items without the hassle of negotiating with other users, which can be particularly time-consuming. Moreover, the algorithms behind these bots are designed to provide fair market values, ensuring that players receive adequate worth for their items.

However, the question remains whether relying on trade bots is truly beneficial or if it diminishes the personal touch of trading. Critics argue that using bots may lead to an impersonal experience, stripping away the social interactions that make trading enjoyable. Additionally, there are concerns regarding the security of personal information when using these automated services. In conclusion, while trade bots can significantly enhance your trading experience in CS2, players must weigh the pros and cons carefully, considering both convenience and the value of community interactions.