News Nexus

Your source for the latest in general news and information.

Trade Bots That Kill the CS2 Market: Are You Ready?

Discover how trade bots are disrupting the CS2 market! Are you prepared to face the revolution? Click to find out!

Understanding Trade Bots: How They Impact the CS2 Market

In the ever-evolving landscape of digital trading, trade bots have emerged as pivotal tools that significantly influence the CS2 market. These automated systems are designed to execute trades at high speeds and with precision, often using complex algorithms to analyze market trends. By monitoring price fluctuations and executing trades based on predefined criteria, trade bots can help traders capitalize on short-term opportunities that might be too fleeting for manual trading. As a result, understanding trade bots becomes essential for anyone looking to navigate the intricacies of the CS2 market effectively.

The impact of trade bots on the CS2 market cannot be overstated. First, they contribute to increased liquidity by enabling a higher volume of transactions within shorter time frames. Second, they often lead to more volatile price movements, as automated buying and selling can create rapid oscillations in market values. Finally, traders must consider the ethical implications and the potential for market manipulation which can arise from heavy reliance on these algorithms. As such, a thorough understanding of trade bots is not just beneficial, but necessary for maximizing trading strategies in the competitive environment of the CS2 market.

Counter-Strike is a team-based first-person shooter that has captivated gamers since its inception. One of the most exciting updates in the game is the Dreams & Nightmares Case, which introduces a variety of new skins and items, enhancing the gameplay experience and allowing players to customize their characters.

Are Trade Bots the Future of CS2 Trading? An In-Depth Analysis

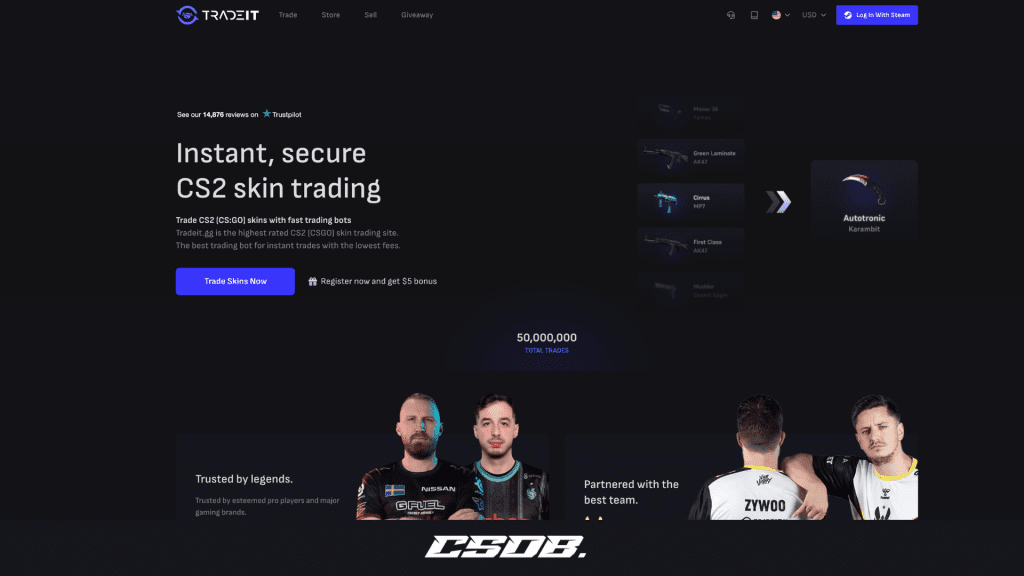

As the gaming community eagerly embraces the evolving landscape of Counter-Strike 2 (CS2), the rise of automated trading solutions has sparked significant interest. Trade bots, equipped with advanced algorithms and real-time market analysis capabilities, have emerged as potential game-changers in the CS2 trading ecosystem. These bots automate the trading process, enabling players to buy, sell, and manage trades with greater efficiency and precision than ever before. Their ability to operate continuously, execute trades within milliseconds, and even analyze market trends in real-time sets them apart from traditional manual trading methods.

However, the question remains: are trade bots the inevitable future of CS2 trading? While their benefits are clear, including time savings and enhanced market responsiveness, there are also concerns regarding trust and security within automated trading systems. Players must weigh the pros and cons carefully—considering factors such as potential risks, the reliability of the bot developer, and the long-term sustainability of automated trading in a dynamic market. As we analyze the trajectory of CS2 trading, it becomes increasingly clear that while trade bots might not be a panacea, they certainly represent a significant shift towards a more efficient trading environment.

Top 5 Trade Bots Dominating the CS2 Market: Pros and Cons

In the rapidly evolving world of CS2 trade bots, several platforms have risen to prominence, offering unique features that cater to different trading strategies. The top five trade bots currently dominating the market include Bot A, Bot B, Bot C, Bot D, and Bot E. Each of these bots presents its own set of advantages and disadvantages, making it essential for traders to assess their needs before choosing a solution. For instance, Bot A is renowned for its user-friendly interface, while Bot B offers advanced customization options.

When evaluating the pros and cons of these trade bots, users should consider factors such as profitability, ease of use, and security. Here’s a brief overview:

- Bot A: Pros: Intuitive design; Cons: Limited features.

- Bot B: Pros: Highly customizable; Cons: Steeper learning curve.

- Bot C: Pros: Automatic updates; Cons: Subscription fees.

- Bot D: Pros: Strong community support; Cons: Slower performance.

- Bot E: Pros: Best analytics tools; Cons: Requires technical knowledge.