News Nexus

Your source for the latest in general news and information.

Cyber Liability Insurance: Your Business's Secret Weapon Against Digital Disasters

Protect your business from digital disasters! Discover how cyber liability insurance can be your ultimate safety net today.

Understanding Cyber Liability Insurance: Essential Coverage for Modern Businesses

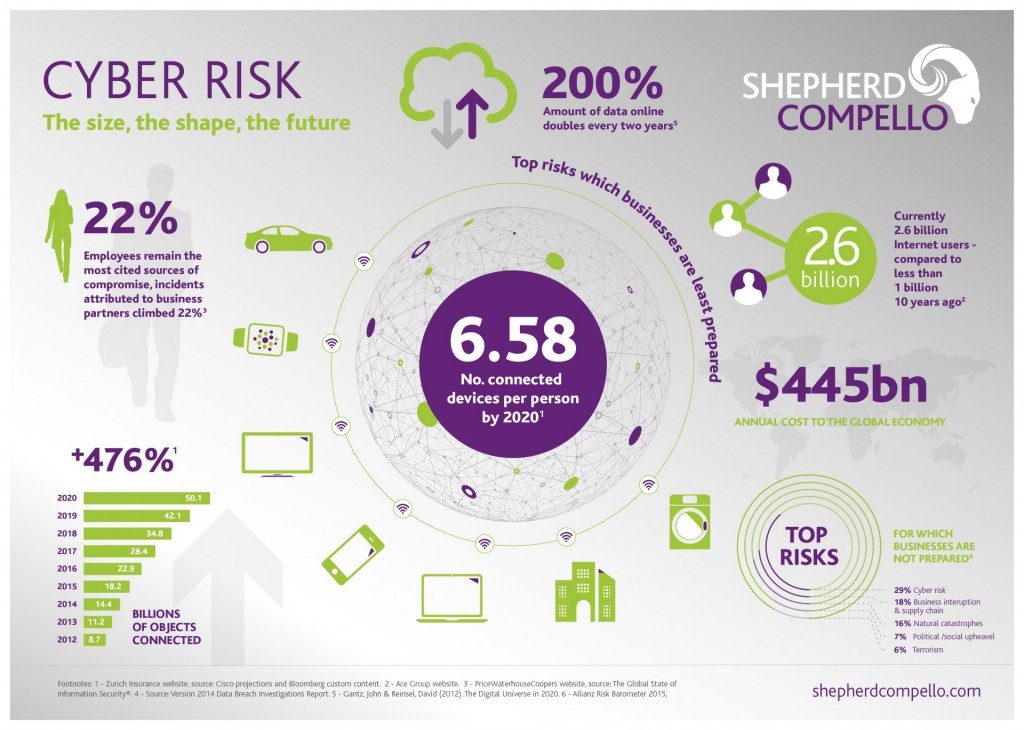

Understanding Cyber Liability Insurance is crucial for modern businesses as the digital landscape continues to evolve. As companies increasingly rely on technology and online platforms, they become more vulnerable to cyber threats such as data breaches and hacking. Cyber liability insurance provides essential coverage that protects businesses from the financial fallout associated with these risks. This type of insurance typically covers expenses related to data recovery, legal fees, and notification costs in the event of a data breach, making it an indispensable asset for any organization operating in today's interconnected world.

In addition to standard coverage, cyber liability insurance often includes risk management services that help businesses proactively safeguard their data. For instance, many policies provide access to cybersecurity training and resources, enabling employees to recognize and mitigate potential threats. As a result, investing in cyber liability insurance not only protects a business's financial interests but also strengthens its overall security posture. In a time when cyber attacks are rampant, understanding and utilizing this essential coverage is a vital step for any modern business aiming to thrive in the digital age.

Top 5 Reasons Your Business Needs Cyber Liability Insurance Today

In today's digital landscape, cyber threats are more prevalent than ever. Businesses of all sizes are at risk of data breaches, ransomware attacks, and other cyber incidents that can lead to significant financial losses. Cyber liability insurance acts as a safety net, providing essential coverage against these risks. Here are the top five reasons your business needs cyber liability insurance today:

- Protection Against Financial Losses: Data breaches and cyberattacks can result in hefty costs, including legal fees, notification expenses, and potential fines. Cyber liability insurance helps mitigate these financial burdens.

- Regulatory Compliance: Many industries are subject to strict data protection regulations. Having cyber liability insurance ensures compliance and helps you manage the complexities of breach notifications effectively.

- Reputation Management: A cyber incident can tarnish your brand's reputation. Insurance can cover public relations efforts to restore trust with your customers.

- Business Interruption Coverage: Cyberattacks can lead to downtime, affecting productivity. Insurance can help cover the lost income and ongoing expenses during recovery.

- Access to Expert Resources: Many insurers provide risk management services, allowing you to strengthen your cybersecurity posture with expert advice and tools.

Is Your Business Prepared for a Cyber Attack? The Case for Cyber Liability Insurance

In today's digital age, the threat of a cyber attack looms larger than ever for businesses of all sizes. A recent survey revealed that nearly 43% of cyber attacks target small businesses, making it imperative for owners to prioritize their cybersecurity measures. This includes not only implementing robust security protocols but also considering the importance of cyber liability insurance. This type of insurance can safeguard your business against the financial repercussions of a data breach, ransomware attack, or other cyber incidents, providing peace of mind in an increasingly perilous landscape.

While it's crucial to invest in prevention and security, no system is infallible. If the unthinkable occurs, having cyber liability insurance can be your lifeline. Such policies typically cover a range of expenses including legal fees, notification costs, and even business interruption losses following a cyber incident. By assessing your risks and understanding the coverage options available, you can ensure that your business is not only prepared for a cyber attack but also equipped to recover swiftly should one occur.