News Nexus

Your source for the latest in general news and information.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover why term life insurance is the safety net you've been missing and how it can protect your loved ones when it matters most!

Understanding Term Life Insurance: Key Benefits and Considerations

Understanding Term Life Insurance is crucial for anyone looking to secure their family's financial future. This type of life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. The main advantage of term life insurance is its affordability; since it is designed to provide a death benefit without a cash value component, premiums are generally lower than those of whole life policies. Here are some key benefits of term life insurance:

- Cost-effective coverage

- Flexible terms that can be tailored to your needs

- Simple and straightforward policy structure

However, there are important considerations to keep in mind when choosing term life insurance. One significant factor is that once the term expires, you no longer have coverage unless you renew, convert, or purchase a new policy. Additionally, premium rates can increase upon renewal, impacting your long-term financial planning. It's crucial to evaluate your personal circumstances and future needs when selecting a term length. Consulting with a financial adviser can help ensure that you make an informed choice that aligns with your goals and provides the necessary protection for your loved ones.

Is Term Life Insurance Right for You? Common Questions Answered

When considering term life insurance, it’s important to evaluate your personal circumstances and financial goals. This type of insurance provides coverage for a specific period, usually ranging from 10 to 30 years. If you’re a parent or a primary breadwinner, term life insurance can offer peace of mind by ensuring financial security for your loved ones in the event of your untimely passing. Below are some common questions to guide your decision-making:

- What is the right coverage amount for my family’s needs?

- How long should I choose my term?

- What happens if I outlive my term?

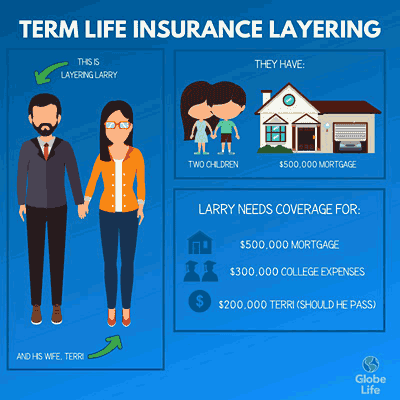

Another crucial aspect to consider is whether term life insurance aligns with your current financial commitments. For instance, if you have significant debts or are financially responsible for children’s education, this type of policy can help cover those costs. However, it’s essential to note that once the term expires, the coverage ends, and you may have to reassess your insurance needs. Therefore, it is wise to ask yourself:

Is my need for coverage temporary, or will it extend beyond the term?

How Term Life Insurance Can Protect Your Family's Future

Term Life Insurance is a financial safety net designed to protect your family's future in the event of an untimely demise. This type of insurance provides a specified death benefit to your beneficiaries, assisting them in covering essential expenses such as mortgage payments, children's education, and daily living costs. By securing a term policy, you ensure that your loved ones will not face financial hardships while they navigate through their grief. Consider this coverage as a crucial part of your family's financial planning, particularly if you're the primary breadwinner or contribute significantly to your household's income.

Moreover, Term Life Insurance is typically more affordable than other types of life insurance, making it accessible for families seeking to secure their future without breaking the bank. Policies can be tailored to fit your needs, with options ranging from 10 to 30 years. This flexibility allows you to choose a term that aligns with critical financial milestones, such as raising children or paying off a mortgage. In addition to offering peace of mind, having a term life insurance policy can enable your family to maintain their standard of living during tough times, ensuring that their future remains bright even in the face of tragedy.