News Nexus

Your source for the latest in general news and information.

Discount Dilemmas: Are You Missing Out on Auto Insurance Savings?

Unlock hidden savings! Discover if you're missing out on auto insurance discounts and start saving today!

10 Common Auto Insurance Discounts You Might Be Overlooking

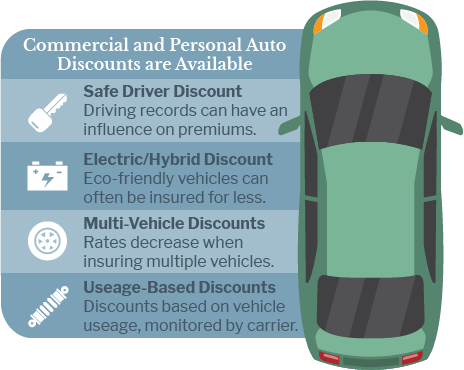

Auto insurance can be a significant monthly expense, but many drivers are unaware of the numerous discounts available to them. Here are 10 common auto insurance discounts you might be overlooking. These discounts can vary widely by insurer, but they often include savings for safe driving records, bundling policies, and even discounts for certain professions. Understanding these can help you save money while ensuring you're adequately covered.

1. Safe Driver Discount: Many companies offer a discount for policyholders with a clean driving record.

2. Multi-Policy Discount: Save by bundling your auto insurance with other types of insurance, such as home or renters insurance.

3. Good Student Discount: Students who maintain a specific GPA may qualify for reduced rates.

4. Low Mileage Discount: If you drive less than a certain number of miles per year, you could be eligible for a discount.

5. Membership Discounts: Being part of certain organizations may entitle you to exclusive discounts.

Utilizing these auto insurance discounts can make a substantial difference in your premiums!

Are You Eligible for More Savings? Exploring Lesser-Known Auto Insurance Discounts

Auto insurance costs can add up quickly, but many drivers are unaware of the various discounts they may qualify for. Are you eligible for more savings? Exploring lesser-known auto insurance discounts can be the key to lowering your premiums significantly. For instance, some insurers offer discounts for safe driving records, but there are also additional options that often go overlooked. Consider asking about discounts for things like:

- Bundling your home and auto insurance

- Low mileage driven annually

- Completing a defensive driving course

- Membership in certain professional organizations

Furthermore, certain lifestyle factors can also lead to substantial savings on your auto insurance. For example, if you have a college degree or if you're a member of the military, you might be eligible for specific discounts. Additionally, maintaining a good credit score can further qualify you for lower rates. It’s essential to regularly review your auto insurance policy and inquire about any potential discounts that could apply to your unique situation. Don't hesitate to explore these lesser-known auto insurance discounts that may be available to help you save more.

Is Your Policy Costing You? How to Identify Missed Auto Insurance Savings

Many drivers often overlook the potential for savings on their auto insurance policies. Understanding the specific factors that contribute to your premium can help you identify whether your policy is costing you more than necessary. Start by reviewing your current coverage limits, deductibles, and types of coverage. Often, insurers will provide discounts for multi-policy holders, safe driving records, or for vehicles equipped with safety features. Additionally, reaching out to your insurer to inquire about available discounts can reveal opportunities you may have previously missed.

Another essential step in pinpointing missed auto insurance savings is to compare quotes from different providers. Online comparison tools can provide insights into competitive rates and potential savings, making it easier to identify if your current policy is priced fairly. Moreover, consider your car's actual market value; maintaining unnecessary comprehensive coverage on an older vehicle could lead to significant cost savings. By conducting a thorough review of your insurance policy and taking the time to explore your options, you can ensure that you are not throwing money away unnecessarily.